A Breakdown Of The Financial Statements Of HYBE Labels’ Subsidiaries In 2023

This article is part of our coverage of HYBE vs. ADOR CEO Min Hee Jin. You can read more and view the entire timeline here.

With the new and tumultuous feud happening between ADOR‘s CEO, Min Hee Jin, and HYBE Labels, discussions about the latter K-Pop label and its subsidiaries have spiked online. At this time, reports of various allegations against Min Hee Jin have been shared, which include:

- ADOR’s internal management (Min Hee Jin, deputy CEOs A and B) receiving external consulting regarding ADOR management, which helped them set up a plan to take over management rights from HYBE.

- Min Hee Jin and deputy CEOs A and B leaking information to foreign investment advisors, private equity firms, securities firm analysts, and consultants, including contract information signed between ADOR and HYBE.

- Accusations that they had secretly tried to manipulate public opinion on HYBE artists negatively to create a bad impression for HYBE.

- Private artists’ information was leaked, including photos and media of the trainees before their debut, as well as personal health information.

Additionally, there are accusations made against Hee Jin that allege she is using NewJeans, ADOR’s single artist, as leverage over HYBE and convince them to release equity of the company. She has also claimed that BELIFT LAB‘s new girl group, ILLIT, is plagiarizing her own group.

ILLIT copying NewJeans is not something that BeLift Lab did themselves, but HYBE was related to it as well. HYBE, who claims to be the leader of K-Pop, was blinded by profits, and they are copying successful culture contents without any hesitation at all. ADOR has never allowed anyone to copy NewJeans’ results.

— Min Hee Jin

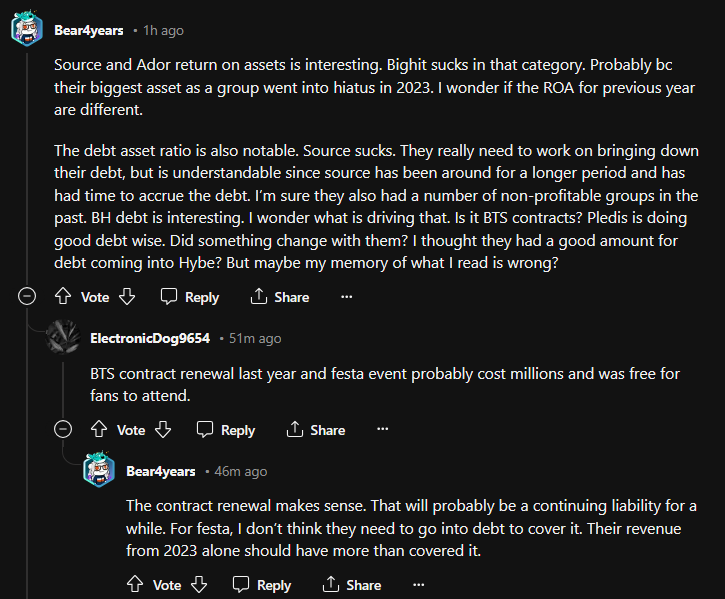

The feud between the two parties is ongoing, with no clear indication to how it’s going to end. It has many fans discussing the potential outcomes, though, and a post was even made on Reddit about the profits of HYBE Labels’ subsidiaries to see how much they would lose if they no longer had NewJeans.

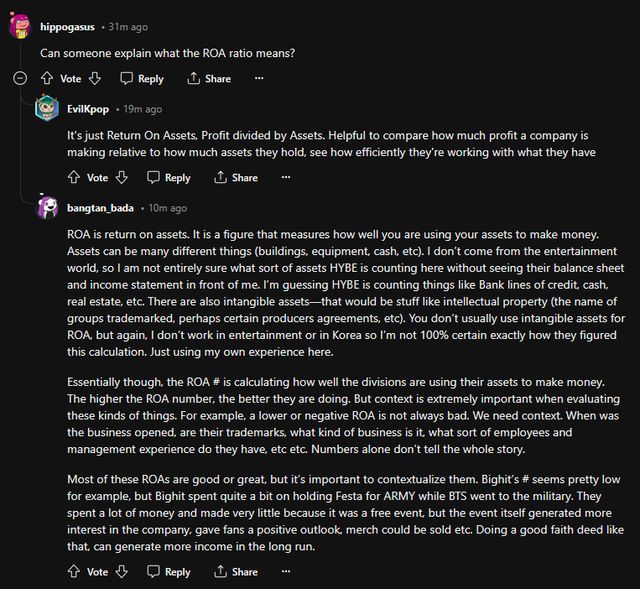

Unsurprisingly, BIGHIT MUSIC (home of BTS and TXT) remains the highest-earning of HYBE’s subsidiaries. In 2023, they had assets that totaled up to about $387.9 million USD, with a debt of $167.8 million USD. Their overall profit last year came to $102.4 million USD, with their debt to asset ratio being 43% and their ROA (return on assets) ratio coming to 26%.

Pledis Entertainment (which owns SEVENTEEN, fromis_9, and TWS) is their next-biggest earner. Their assets totaled $139.3 million USD in 2023, with a debt of $52.9 million USD and overall profit at $44.0 million USD. Their debt to asset ratio was 38%, and their ROA ratio was 32%.

HYBE Japan (home to &TEAM) surprisingly is their third most-profitable, with $291.4 million USD in assets last year and $125.5 million USD in debt. Their total profits came to $36.4 million USD, with a debt/asset ratio of 43% and an ROA ratio of 12%.

ADOR is next in line. Their assets totaled $45.0 million USD in 2023, impressive for a still-young girl group like NewJeans. Their debts came to $15.9 million USD, with their overall profit coming to $19.4 million USD. Their debt/asset ratio was 35%, and their ROA ratio was 43%.

Their three other subsidiaries — SOURCE MUSIC (LE SSERAFIM), BELIFT LAB (ENHYPEN and ILLIT), and KOZ Entertainment (BOYNEXTDOOR) — had total profits of $8.88 million USD, $3.86 million USD, and -$5.29 million USD respectively in 2023. SOURCE MUSIC’s assets were at $19.5 million USD with debts at $16.9 million USD, BELIFT’s assets were $38.6 million USD while their debts were at $18.1 million USD, and KOZ’s assets of $10.2 million USD were outweighed by their debt of $11.3 million USD.

This data was shared on a Reddit post recently, and here’s how people are responding.

Does your opinion on the Min Hee Jin/HYBE feud change with these statistics?